Time Series Forecasting¶

Step 01 Introduction¶

As a data scienst team, we are working with a real estate company in Beijing, China. We have been asked to determine whether sales for the real estate company are incerasing or declining.

This Time Series Forecasting project is another side of the other Beijing housing price project, especially regarding foecasting instead of regression.

Data¶

The housing price data is succeeded from step 3 in the other project. In addition, we also use some market prices or index to improve forecasting accuracy.

Step 02 Data Wranging¶

Imports¶

import warnings

warnings.filterwarnings('ignore')

import pandas as pd

import numpy as np

import os

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.preprocessing import scale

from library.sb_utils import save_file

%matplotlib inline

# Optional Plotly Method Imports

import plotly

import cufflinks as cf

cf.go_offline()

# These for time series statistics

from statsmodels.tsa.stattools import adfuller,kpss,coint,bds,q_stat,grangercausalitytests,levinson_durbin

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf # for determining (p,q) orders

from statsmodels.tsa.seasonal import seasonal_decompose # for ETS Plots

from pmdarima import auto_arima # for determining ARIMA orders

from statsmodels.tools.eval_measures import rmse

Configuration¶

# Set the number of display

pd.set_option('display.max_columns', 100)

pd.set_option('display.max_rows', 100)

pd.options.display.float_format = '{:.4f}'.format

Load The Data¶

df = pd.read_csv('../data/df_data_step3a_EDA.csv',parse_dates = ['tradeTime'])

df_sales = pd.read_csv('../data/time_sales_data_step3a_EDA.csv',index_col='tradeTime',parse_dates = ['tradeTime'],)

df_10yrBond = pd.read_csv('../raw_data/China 10-Year Bond Yield Historical Data.csv',index_col='Date',parse_dates = True)

df_hmi = pd.read_csv('../raw_data/Real Residential Property Prices for China.csv',index_col='DATE',parse_dates = True)

df_sse = pd.read_csv('../raw_data/SSE Composite Index (000001.SS) Historical Data - Yahoo Finance.csv',index_col='Date',parse_dates = True)

Clean the data¶

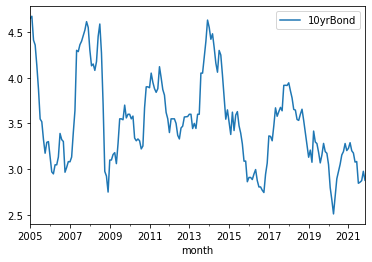

China 10-Year Bond Yield Historical Data¶

Data overview¶

df_10yrBond.head()

There are some unnecessary columns.

Type of index¶

df_10yrBond.index

Frequency is 'MS'.

Clean data and rename the columns¶

We use only Date and price of the 10 years bond. Date is monthly freq, so it be renamed.

df_10yrBond.rename(columns={'Price':'10yrBond',},inplace=True)

df_10yrBond.drop(columns=[ 'Open', 'High', 'Low', 'Change %'],inplace=True)

df_10yrBond.index.names=['month']

# df_10yrBond.index.astype('datetime64[ns]')

df_10yrBond.index

Now, we transform the index format to the same one as the tradeTime in the original housing price data.

# https://stackoverflow.com/questions/58490016/convert-mmm-yy-to-date-time-in-python

df_10yrBond.index = pd.to_datetime(df_10yrBond.index,format='%b %y').strftime('20%y-%m-01')

df_10yrBond.index = pd.to_datetime(df_10yrBond.index)

Make a new dataset, called market, to use in the next steps¶

market = df_10yrBond.copy()

# set index frequency

market.index.freq='MS'

# Visually check the data

market.plot();

China Housing Market Index¶

Data overview¶

# Check the data

df_hmi.head()

Rename the columns¶

# Rename the coluns as hmi, home market index

df_hmi.rename(columns={'QCNR628BIS':'hmi'},inplace=True)

df_hmi.index.names=['quarter']

df_hmi.head()

Add to market dataset¶

# Add and resent the name

market = pd.concat([market, df_hmi],axis=1)

market.index.names=['MS']

The original hmi has only quater based data. To convert it to mothly data, ffill method in fillna function be applied.

market.hmi = market.hmi.fillna(method='ffill')

market.head()

# Check the graph

market['10yrBond'].plot();

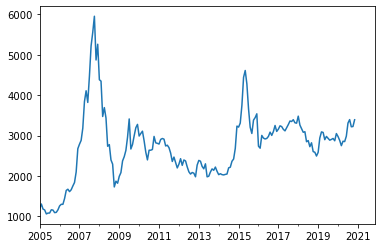

SSE Composite Index (000001.SS) from Yahoo Finance¶

SSE (SHANGHAI STOCK EXCHANGE) is one of the major stock index in China.

Data overview¶

# Check the contents in the SSE data.

df_sse.head()

There are some unnecessary columns, which be removed.

# Drop unnecessary columns

df_sse.drop(columns=[ 'Open', 'High', 'Low','Adj Close', 'Volume'],inplace=True)

# Rename the columns

df_sse.index.names=['month']

df_sse.rename(columns={'Close':'sse'},inplace=True)

df_sse.head()

Add to market dataset¶

market = pd.concat([market, df_sse],axis=1)

market.head()

market.info();

# Check the graph

market.sse.plot();

We will smooth this sse in the same way as 10 years bond.

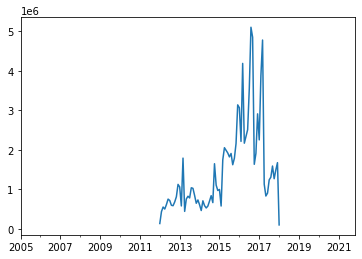

Total Sales data¶

This is from the file, Regression the step 3 EDA.

Add to market dataset¶

market = pd.concat([market, df_sales[['totalSales']]],axis=1)

# Check the graph

market['totalSales'].plot();

Step 03 Explore The Data¶

Time series data¶

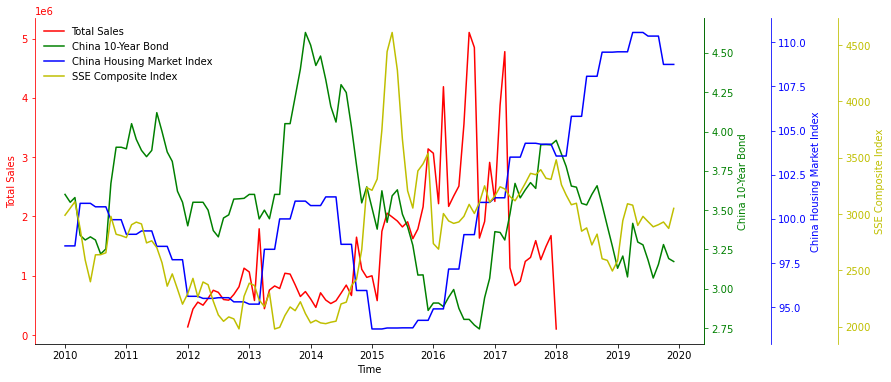

Here, we check visually the relationship between the totalSales and other market prices for the period extended by 2 years, which are from 2010(2012-2) to 2020(2017+2).

# https://stackoverflow.com/questions/20356982/matplotlib-colour-multiple-twinx-axes

def threeTimeSeries(market):

"""

This is a function to make a gragh showing 1 plus three inconsistent units of time series data.

"""

fig, host = plt.subplots(

figsize=(12, 6)

)

fig.subplots_adjust(

# right=0.75

)

par1 = host.twinx()

par2 = host.twinx()

par3 = host.twinx()

# move the spine of the second axes outwards

par2.spines["right"].set_position(("axes", 1.1))

par3.spines["right"].set_position(("axes", 1.2))

p1, = host.plot(market.index, market.totalSales, 'r-', label="Total Sales")

p2, = par1.plot(market.index, market['10yrBond'], 'g-', label="China 10-Year Bond")

p3, = par2.plot(market.index, market.hmi, 'b-', label="China Housing Market Index")

p4, = par3.plot(market.index, market['sse'], 'y-', label="SSE Composite Index")

host.set_xlabel("Time")

host.set_ylabel("Total Sales")

par1.set_ylabel("China 10-Year Bond")

par2.set_ylabel("China Housing Market Index")

par3.set_ylabel("SSE Composite Index")

# host.set_xlim(df_10yrBond.index.min(),df_10yrBond.index.max())

lines = [p1, p2, p3, p4]

host.legend(lines, [l.get_label() for l in lines],loc='upper left',)

for ax in [par1, par2, par3]:

ax.set_frame_on(True)

ax.patch.set_visible(False)

plt.setp(ax.spines.values(), visible=False)

ax.spines["right"].set_visible(True)

host.yaxis.label.set_color(p1.get_color())

par1.yaxis.label.set_color(p2.get_color())

par2.yaxis.label.set_color(p3.get_color())

par3.yaxis.label.set_color(p4.get_color())

host.spines["left"].set_edgecolor(p1.get_color())

par1.spines["right"].set_edgecolor(p2.get_color())

par2.spines["right"].set_edgecolor(p3.get_color())

par3.spines["right"].set_edgecolor(p4.get_color())

host.tick_params(axis='y', colors=p1.get_color())

par1.tick_params(axis='y', colors=p2.get_color())

par2.tick_params(axis='y', colors=p3.get_color())

par3.tick_params(axis='y', colors=p4.get_color())

host.spines['top'].set_visible(False)

# host.legend(loc, bbox_to_anchor=(0.6,0.5))

try:

# Remove frame color

frame = host.legend_.get_frame()

frame.set_facecolor('1.0')

frame.set_edgecolor('1.0')

except:

pass

threeTimeSeries(market.loc['2010-01-01':'2019-12-31'])

There seems to be more correlation between total sales and China 10-year Bond than the others.

Weekly Seasonal Decomposition¶

Here, we check the trend and seasonality of original total sales data, which is not yet smoothed as above.

# Import necessary libraries

from statsmodels.tsa.seasonal import seasonal_decompose

def plotseasonal(col):

fig, axes = plt.subplots(ncols=1, nrows=4, sharex=True, figsize=(12,5))

res = seasonal_decompose(df_sales[col].dropna())

res.observed.plot(ax=axes[0], legend=False)

axes[0].set_ylabel('Observed')

res.trend.plot(ax=axes[1], legend=False)

axes[1].set_ylabel('Trend')

res.seasonal.plot(ax=axes[2], legend=False)

axes[2].set_ylabel('Seasonal')

res.resid.plot(ax=axes[3], legend=False)

axes[3].set_ylabel('Residual')

plt.tight_layout()

plt.show()

from IPython import display

from ipywidgets import interact, widgets

interact(plotseasonal,

col=widgets.ToggleButtons(

options=list(df_sales.columns),

value='totalSales',

description='district:',

disabled=False,

button_style='', # 'success', 'info', 'warning', 'danger' or ''

)

);

There are trend adn seasonality are found.

Tests for Stationarity¶

We use Augmented Dickey-Fuller Test

from statsmodels.tsa.stattools import adfuller

def adf_test(series,title=''):

"""

Pass in a time series and an optional title

Returns an ADF report

"""

print(f'Augmented Dickey-Fuller Test: {title}')

result = adfuller(series.dropna(),autolag='AIC') # .dropna() handles differenced data

labels = ['ADF test statistic','p-value','# lags used','# observations']

out = pd.Series(result[0:4],index=labels)

for key,val in result[4].items():

out[f'critical value ({key})']=val

print(out.to_string()) # .to_string() removes the line "dtype: float64"

if result[1] <= 0.05:

print("Strong evidence against the null hypothesis")

print("Reject the null hypothesis")

print("Data has no unit root and is stationary")

else:

print("Weak evidence against the null hypothesis")

print("Fail to reject the null hypothesis")

print("Data has a unit root and is non-stationary")

# refer to www.pieriandata.com

adf_test(market['totalSales'].dropna(),title='Augmented Dickey-Fuller Test on totalSales Data')

adf_test(market['totalSales'].diff().dropna(),title='Augmented Dickey-Fuller Test on totalSales Data')

One differenciation makes the stationality better.

adf_test(market['totalSales'].diff().diff().dropna(),title='Augmented Dickey-Fuller Test on totalSales Data')

Two differentiation does not necessarily make it better. Therefore, we will use one differenciation in the further modeling.

Change %¶

We use pandas pct_change() method on each column to create a column representing the increase(up) in each market value compared to previous month. The unit is percentage %.

pC = pd.DataFrame()

pC.index.names = ['MS']

for c in market.columns:

pC[c+'_up%'] = market[c].pct_change()

pC.head()

Time Series - Feature Correlation¶

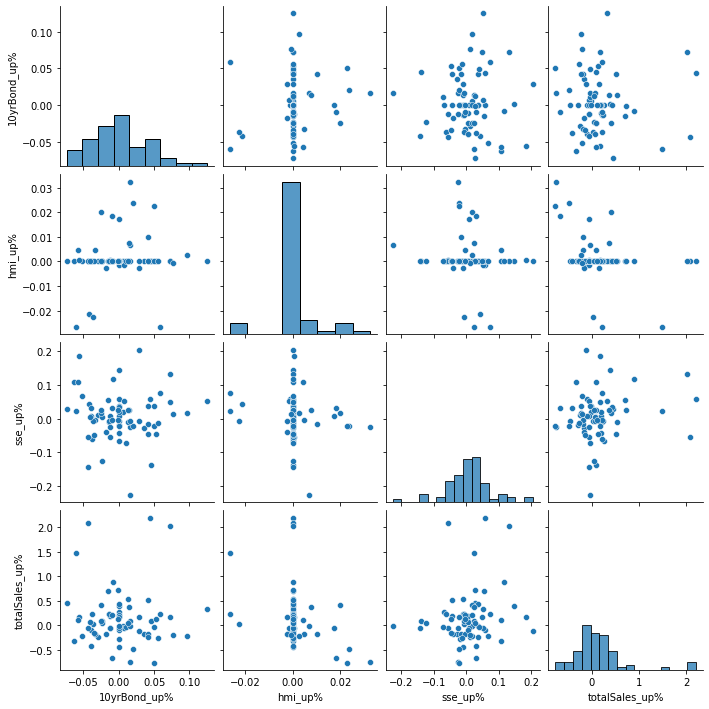

Here, we check the correlation of feature values and target value(totalSales).

Firstly, we maerge all data into a data set.

sns.pairplot(pC.loc['2012-01-01':'2017-12-31']);

Create a heat map

# Make a function to create a correlations map

def correlations(df,targetLabel,ncol=None,fs=(12,6)):

if ncol is None:

ncol = 1

nrow = 1

f, ax = plt.subplots(nrow,ncol,figsize=fs)

c = list(df.columns)

c.remove(targetLabel)

c.append(targetLabel)

# Compute the correlation matrix

corr = df[c].corr()

# Generate a mask for the upper triangle

mask = np.triu(np.ones_like(corr, dtype=bool))

# Draw the heatmap with the mask and correct aspect ratio

sns.heatmap(corr, mask=mask, cmap='coolwarm', vmax=1, vmin=-1, center=0,

square=True, linewidths=.5, cbar_kws={"shrink": .5},

annot=True,

fmt=".1f",

ax=ax

)

plt.tight_layout();

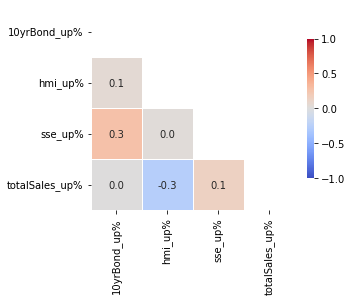

correlations(pC,'totalSales_up%',fs=(5,5));

With regards to totalSales_up%, weak pairwise correlation of the percent changes are found in hmi and sse.

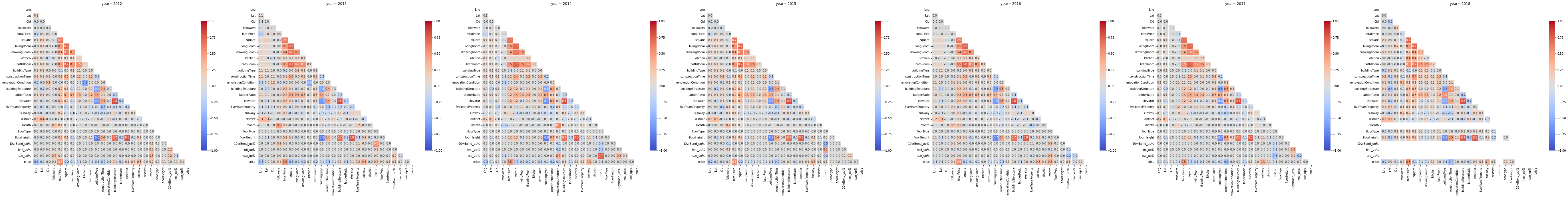

Correlation map By Year¶

In Regression Step 03 EDA, we have already explored the pairwise correlation of columns in the original housing price data(df).

Here, we explore in the same way, but with addional information of following three increase in market values.

- '10yrBondSmul12_up%'

- 'hmi_up%'

- 'sseSmul12_up%'

df['MS']=pd.to_datetime(df.tradeTime,format='%Y-%m-%dd').dt.strftime('%Y-%m-01').astype(str)

pC = pC.reset_index()

pC.MS = pC.MS.astype(str)

df = df.merge(pC.drop(columns=['totalSales_up%']),how='left',on='MS')

df.drop(columns=['MS'],inplace=True)

mask_df = (df.tradeTime>='2015-01-01') & (df.tradeTime<='2017-12-31')

# Make a list, c, to put price in the last

def mapCorrelationsByYear(df, ncol=None, figsize=(15, 8)):

"""

Input dataframe as df.

Return triangular shape corr map By Year

"""

f, axes = plt.subplots(1,len(df.year.unique()),figsize=(11*len(df.year.unique()), 9*len(df.year.unique())))

for i, year in enumerate(df.year.unique()):

if ncol is None:

ncol = 1

nrow = 1

temp=df[df.year==year].drop(columns='year')

c = list(temp.columns)

c.remove('price')

c.append('price')

# Compute the correlation matrix

corr = temp[c].corr()

# Generate a mask for the upper triangle

mask = np.triu(np.ones_like(corr, dtype=bool))

# Draw the heatmap with the mask and correct aspect ratio

sns.heatmap(corr, mask=mask, cmap='coolwarm', vmax=1, vmin=-1, center=0,

square=True, linewidths=.5, cbar_kws={"shrink": .1},

annot=True,

fmt=".1f",

ax=axes[i]

)

axes[i].set(title='year= '+str(year))

plt.tight_layout();

mapCorrelationsByYear(df, ncol=None, figsize=(15, 8))

This is slightly hard to compare to see how each feature values affect price. Next, we just focus on the correlations with price.

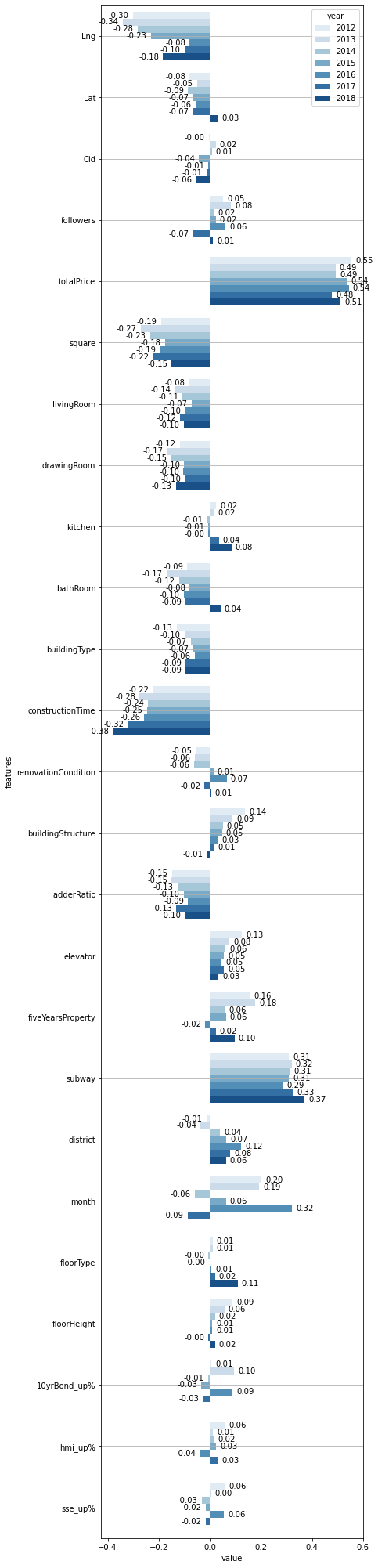

Corelation bar By Year¶

def makeTrans(df):

"""

Input dataframe

Return a new dataframe used to make 'Corelation bar By Year'.

"""

for i,year in enumerate(df.year.unique()):

temp=df[df.year==year].drop(columns='year').corr()

if i==0:

corrs = pd.DataFrame(columns=list(temp.columns))

corrs.loc[year]=temp['price']

else:

corrs.loc[year]=temp['price']

corrs.drop('price',axis=1,inplace=True)

trans = corrs.T

trans = trans.reset_index().rename(columns={'index':'features'}).melt('features', var_name='year')

return trans

trans = makeTrans(df)

# https://github.com/jbmouret/matplotlib_for_papers/blob/master/src/plot_variance_matplotlib_white.py

def clean_layout(ax):

"""

This function is only to make layout as cleaner as possible

"""

# # Delete unnecessary lines

# ax.spines['top'].set_visible(False)

# ax.spines['right'].set_visible(False)

# ax.spines['left'].set_visible(False)

try:

# Remove frame color

frame = ax.legend_.get_frame()

frame.set_facecolor('1.0')

frame.set_edgecolor('1.0')

except:

pass

# y axis grid line

ax.grid(axis='y', color="0.9", linestyle='-', linewidth=1)

ax.set_axisbelow(True)

def barCorrelationsByYear(trans):

"""

Input dataframe as df

Return bar corr map By Year

"""

fig, ax = plt.subplots(1,1,figsize=(6,36))

ax = sns.barplot(data=trans, x="value", hue="year", y="features", palette="Blues");

rects = ax.patches

# Make some labels

labels = [f"label{i}" for i in range(len(rects))]

# For each bar: Place a label

for rect in rects:

# Get X and Y placement of label from rect.

x_value = rect.get_width()

y_value = rect.get_y() + rect.get_height() / 2

# Number of points between bar and label. Change to your liking.

space = 5

# Vertical alignment for positive values

ha = 'left'

# If value of bar is negative: Place label left of bar

if x_value < 0:

# Invert space to place label to the left

space *= -1

# Horizontally align label at right

ha = 'right'

# Use X value as label and format number with one decimal place

label = "{:.2f}".format(x_value)

# Create annotation

plt.annotate(

label, # Use `label` as label

(x_value, y_value), # Place label at end of the bar

xytext=(space, 0), # Horizontally shift label by `space`

textcoords="offset points", # Interpret `xytext` as offset in points

va='center', # Vertically center label

ha=ha) # Horizontally align label differently for

# positive and negative values.

# clean_layout(ax)

ax.grid(axis='y')

barCorrelationsByYear(trans)

This simple corelation coefficients manifests following relationships.

- Subway has the most strong positive relationship with price among the features.

- constructionTime shows the most negative strong, meaning that the newer house has the lower price (totalPrice/square). ...showing some democracy

** totalPrice is exclueded here as it equals to square times price.

Useful data for forecasting¶

In oredr to find another useful data to improve forecasting, we perform Granger causality test.

The candidates are sse, bond, and hmi.

The function takes in a 2D [y(first column),x(second column)] and a maximum number of lags to test on x.

With regards to the two series, 𝑦 and 𝑥 , the null hypothesis is that lagged values of 𝑥 do not explain variations in 𝑦 .

totalSales vs 10yrBond¶

# Here y is set as 'totalSales', and x is set as '10yrBond' which is tested to be lagged.

grangercausalitytests(market[['totalSales','10yrBond']].loc['2012-01-01':'2017-12-31'].dropna(),maxlag=12);

Granger Causality shows that 1 month lag denies the null hypothesis. So, we can not refuse that 10yrBond explains variations in totalSales upto 2 months.

totalSales vs hmi¶

grangercausalitytests(market[['totalSales','hmi']].loc['2012-01-01':'2017-12-31'].dropna(),maxlag=12);

As for hmi (home market index), there seems to be no causual relationship between 'totalSales' and 'hmi'.

totalSales vs sse¶

grangercausalitytests(market[['totalSales','sse']].loc['2012-01-01':'2017-12-31'].dropna(),maxlag=12);

As for sse(stock price), it is 8 months lag that it is the most loikely that Granger Causality denies the null hypothesis. Therefore, we can not refuse that sse explains variations in totalSales.

Among the three, we choose 10 yr bond as the most related feature to sales.

Step 04 Preprocessing and training¶

Split the data into train/test sets¶¶

data = market[['totalSales','10yrBond']].loc['2015-01-01':'2017-12-31']

y = data['totalSales']

exog1 = data['10yrBond']

# len(y),len(exog1)

# This is for Facebook's Prophet.

df_prophet = data[['totalSales']]

df_prophet.reset_index(inplace=True)

df_prophet.columns = ['ds','y']

# Define the split line between train and test data

split=int(len(data) * 0.8)

# Make train and test variables, with 'train, test'

data_train, data_test = data.iloc[:split], data.iloc[split:]

y_train, y_test = y.iloc[:split].to_frame(), y.iloc[split:].to_frame()

Forecast using only time series data¶

Run pmdarima.auto_arima to obtain recommended orders¶

# For SARIMA Orders we set seasonal=True and pass in an m value

auto_arima(y,

seasonal=True,

trace=True,

error_action='ignore',

suppress_warnings=True,

).summary()

SARIMA model¶

To make a time-series forecast, firstly we set some parameters necessary for the forecast.

# Load specific forecasting tools

from statsmodels.tsa.statespace.sarimax import SARIMAX

from sklearn.metrics import mean_squared_error

from itertools import product

# Make a function called evaluate_sarimax_model

def evaluate_sarimax_model(data, order,seasonal_order, exog=None):

"""

Input dataframe as data

and order and seasonal_order to be used in the SARIMAX

Return error_mse,error_rmse, y_test, f(forecast on y_test)

"""

# Needs to be an integer because it is later used as an index.

split=int(len(data) * 0.8)

# Make train and test variables, with 'train, test'

y_train, y_test = data.iloc[:split], data.iloc[split:]

past=[x for x in y_train]

try:

exog_train, exog_test = exog.iloc[:split], exog.iloc[split:]

e=exog_test[0]

except:

exog_train, exog_test,e=None,None,None

try:

exog_forecast = exog_test.to_frame()

past_exog = [x for x in exog_train]

except:

exog_forecast=None

past_exog=None

# make predictions

f = list()

for i in range(len(y_test)):#timestep-wise comparison between test data and one-step prediction ARIMA model.

model = SARIMAX(past,order=order,seasonal_order=seasonal_order,exog=past_exog,

# enforce_invertibility=False,

)

model_fit = model.fit(disp=0)

future = model_fit.forecast(exog=e)[0]

f.append(future)

past.append(y_test[i])

if past_exog!=None:

past_exog.append(exog_test[i])

e=exog_test[i]

# calculate out of sample error

error_mse = mean_squared_error(y_test, f)

error_rmse = rmse(y_test, f)

# Return the error

return [error_mse,error_rmse, y_test, f]

error_mse, error_rmse, test, f = evaluate_sarimax_model(y,(0,0,1),(0,0,1,12), exog=None)

print('error_mse %.5e, error_rmse %.0f'% (error_mse, error_rmse))

ModelComparison = pd.DataFrame([{'Model name':'SARIMA with auto_arima',

'MAE':error_mse,

'Best para':'(0,0,1),(0,0,1,12)',

}

])

ModelComparison

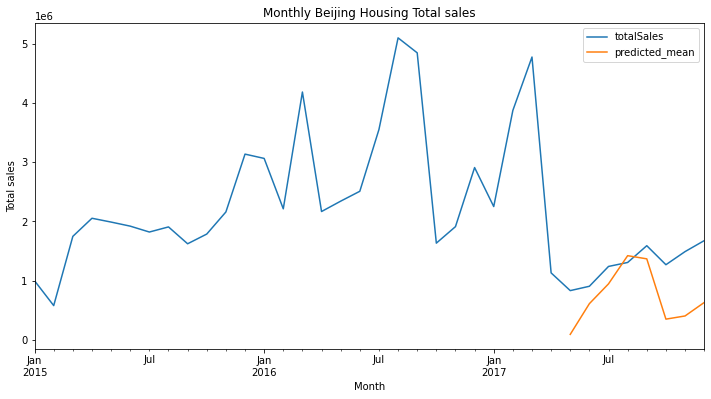

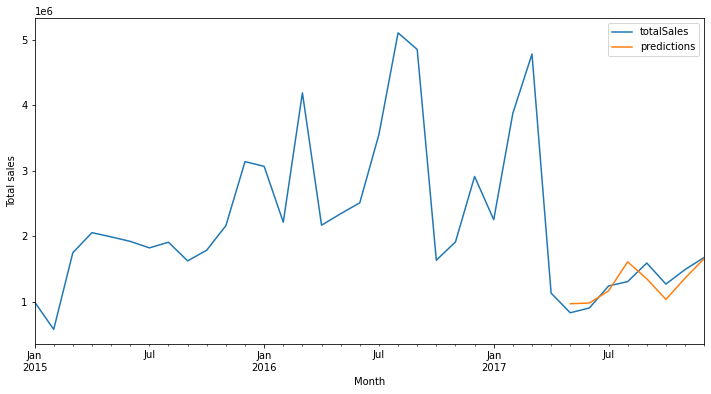

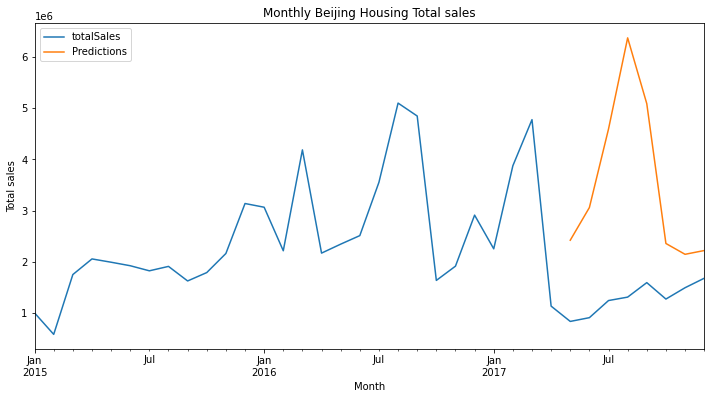

Compare predictions to expected values¶

Visualize the results.

# Plot predictions against known values

title ='Monthly Beijing Housing Total sales'

ylabel='Total sales'

xlabel='Month'

# Refit the model

model = SARIMAX(y_train, order=(0,0,1),seasonal_order=(0,0,1,12))

model_fit = model.fit(disp=0)

predictions = model_fit.forecast(len(y_test))

# ax = market['totalSales'].loc['2015-01-01':'2017-12-31'].plot(legend=True,figsize=(12,6),title=title)

ax = y.plot(legend=True,figsize=(12,6),title=title)

predictions.plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

This is the result based on the parameters advised by the auto_arima, and we use this as base model.

Step 05 Modeling¶

SARIMA with Grid Search for different p, d, and q values.¶

I have tried making use of gridsearcv function, but it kept causing error, so here we do manually with for loops.

# Make a function to evaluate different ARIMA models with several different p, d, and q values.

def evaluate_models(y, p_values, d_values, q_values, P_values,D_values,Q_values, m_values,exog=None):

best_score, best_odrder, best_sesonal_order = float("inf"), None, None

grid_search = pd.DataFrame(columns=['p','d','q','P','D','Q','m','mse','rmse'])

# Iterate through p_values

for p in p_values:

# Iterate through d_values

for d in d_values:

# Iterate through q_values

for q in q_values:

for P in P_values:

for D in D_values:

for Q in Q_values:

for m in m_values:

# p, d, q iterator variables in that order

order = (p,d,q)

seasonal_order = (P,D,Q,m)

# print('==Now working on order%s,seasonal_order%s==' % (order,seasonal_order))

mse,rmse=None,None

ps=[p,d,q,P,D,Q,m,mse,rmse]

params = {'p':p, 'd':d, 'q':q, 'P':P, 'D':D, 'Q':Q, 'm':m, 'mse':mse,'rmse':rmse}

try:

# Make a variable called mse for the Mean squared error

mse,rmse = evaluate_sarimax_model(y, order, seasonal_order,exog=exog)[:2]

grid_search = grid_search.append(pd.Series(ps, index = grid_search.columns), ignore_index=True)

if mse < best_score:

best_score, best_odrder, best_sesonal_order = mse, order, seasonal_order

# print('SARIMAX %s,%s \t\tMSE=%.3f' % (order,seasonal_order,mse))

except:

continue

# print('MSE=%.3f RMSE=%.3f' % (mse,rmse))

print(grid_search.dropna().sort_values('mse').head(1))

print('Best SARIMAX %s %s MSE=%.3f' % (best_odrder, best_sesonal_order, best_score))

return [best_odrder, best_sesonal_order, best_score]

p_values = [x for x in range(0, 3)]

d_values = [x for x in range(0, 3)]

q_values = [x for x in range(0, 3)]

P_values = [x for x in range(0, 3)]

D_values = [x for x in range(0, 3)]

Q_values = [x for x in range(0, 3)]

m_values = [3,4,6,12]

import json

try:

with open("../data/sarima.json", 'r') as f:

best_odrder1, best_sesonal_order1, best_score1 = json.load(f)

except:

import warnings

warnings.filterwarnings("ignore")

best_odrder1, best_sesonal_order1, best_score1 = evaluate_models(y, p_values, d_values, q_values, P_values,D_values,Q_values, m_values)

with open("../data/sarima.json", 'w') as f:

# indent=2 is not needed but makes the file human-readable

json.dump( [best_odrder1, best_sesonal_order1, best_score1], f)

print('According to this grid search, \

the best model parameter is SARIMAX %s %s and MSE is %.5e'\

% (best_odrder1, best_sesonal_order1, best_score1))

# Add the metrics to the ModelComparison

def addModel(df1,name,best_score,Best_para):

# Set a variable for Best para

df2=pd.DataFrame([{'Model name':str(name),

'mse':best_score,

# 'RMSE':np.sqrt(mean_squared_error(y_test,predictions)),

# 'Explained_variance_score':explained_variance_score(y_test,predictions),

'Best para': Best_para,

}

])

return pd.concat([df1,df2],axis=0)

ModelComparison = addModel(ModelComparison,'SARIMA with Grid Search',best_score1,str(best_odrder1)+','+str(best_sesonal_order1))

ModelComparison

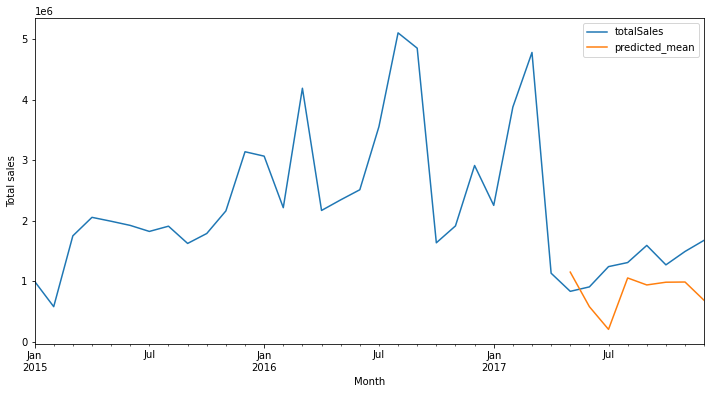

# Plot predictions against known values

title =''

ylabel='Total sales'

xlabel='Month'

# Refit the model

model = SARIMAX(y_train, order=best_odrder1,seasonal_order=best_sesonal_order1)

model_fit = model.fit(disp=0)

predictions = model_fit.forecast(len(y_test))

# ax = market['totalSales'].loc['2015-01-01':'2017-12-31'].plot(legend=True,figsize=(12,6),title=title)

ax = y.plot(legend=True,figsize=(12,6),title=title)

predictions.plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

This result is much better than the previous one.

SARIMAX, SARIMA with an exogenous variable¶

Fit a model¶

Among the three market values, 10yrBond had the lower p-value. Next, we make use of this 10yrBond.

error_mse, error_rmse, test, f = evaluate_sarimax_model(y,exog=exog1,order=best_odrder1,seasonal_order=best_sesonal_order1)

print('error_mse %.5e, error_rmse %.0f'% (error_mse, error_rmse))

predictions= data_test[[]].copy()

predictions['predictions']=f

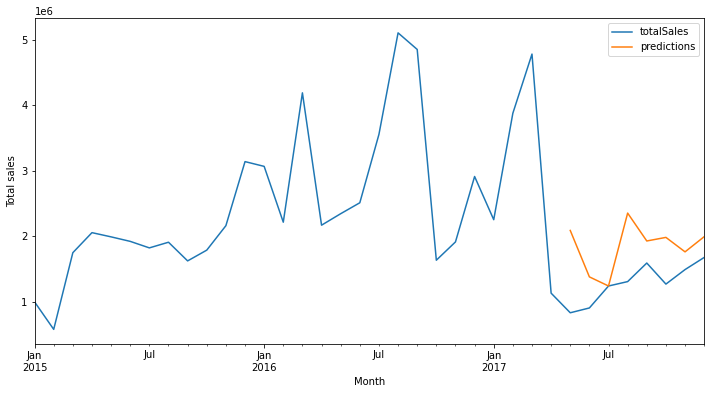

# Plot predictions against known values

title =''

ylabel='Total sales'

xlabel='Month'

ax = y.plot(legend=True,figsize=(12,6),title=title)

predictions['predictions'].plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

Grid search¶

import json

try:

with open("../data/sarimax.json", 'r') as f:

best_odrder2, best_sesonal_order2, best_score2 = json.load(f)

except:

import warnings

warnings.filterwarnings("ignore")

best_odrder2, best_sesonal_order2, best_score2 = evaluate_models(y, p_values, d_values, q_values, P_values,D_values,Q_values, m_values)

with open("../data/sarimax.json", 'w') as f:

# indent=2 is not needed but makes the file human-readable

json.dump( [best_odrder2, best_sesonal_order2, best_score2], f)

error_mse, error_rmse, test, f = evaluate_sarimax_model(y,exog=exog1,order=best_odrder2,seasonal_order=best_sesonal_order2,)

print('error_mse %.5e, error_rmse %.0f'% (error_mse, error_rmse))

This error is the lowest ever.

ModelComparison = addModel(ModelComparison,'SARIMAX with Grid Search',best_score2,str(best_odrder2)+' '+str(best_sesonal_order2))

ModelComparison

# Refit the model

predictions= data_test[[]].copy()

predictions['predictions']=f

# Plot predictions against known values

title =''

ylabel='Total sales'

xlabel='Month'

ax = y.plot(legend=True,figsize=(12,6),title=title)

predictions['predictions'].plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

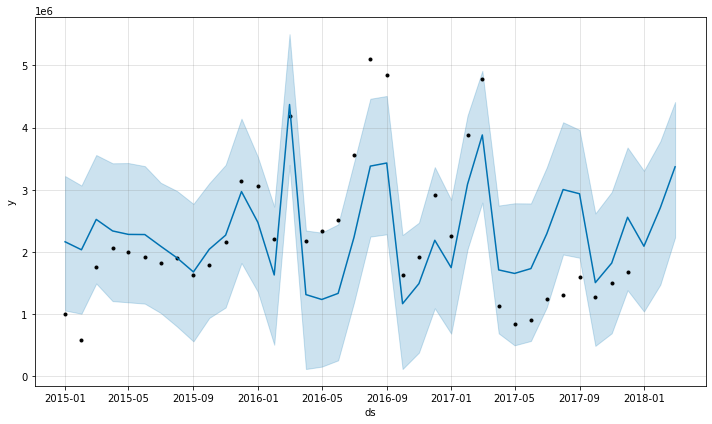

Facebeook's Prophet¶

import pandas as pd

from fbprophet import Prophet

%matplotlib inline

m = Prophet(

# weekly_seasonality=True,

# daily_seasonality=True,

seasonality_mode='multiplicative',

)

m.fit(df_prophet)

future = m.make_future_dataframe(3, freq='MS')

forecast = m.predict(future)

fig = m.plot(forecast);

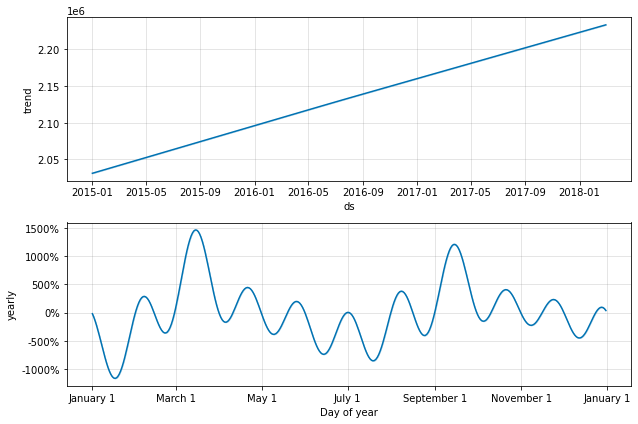

fig = m.plot_components(forecast)

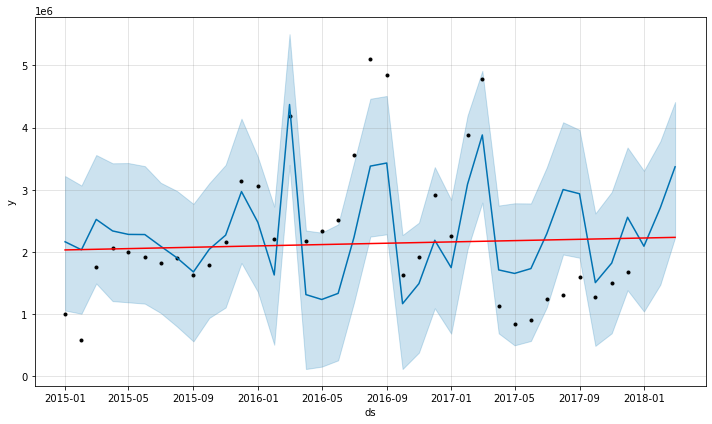

from fbprophet.plot import add_changepoints_to_plot

fig = m.plot(forecast)

a = add_changepoints_to_plot(fig.gca(), m, forecast)

Error Evaluation¶

Here we calcualte the errors to compare with the others.

len(data_train)

data_test['totalSales']

start=len(data_train)

end=len(data_train)+len(data_test)-1

predictions = forecast.iloc[start:end+1]['yhat']

print('mse %.5e'% (mean_squared_error(predictions,data_test['totalSales'])))

Although the time of preparation and calculation is much faster than the ARIMAX, this score of error was much worse. This may be because the data we used to train the model was too low.

ModelComparison = addModel(ModelComparison,"Facebook's Prophet",mean_squared_error(predictions,data_test['totalSales']),None)

ModelComparison

RNN (Recurrent Neural Network)¶

Scale Data¶

from sklearn.preprocessing import MinMaxScaler

scaler = MinMaxScaler()

scaler.fit(y_train)

scaled_train = scaler.transform(y_train)

scaled_test = scaler.transform(y_test)

Time Series Generator¶

from keras.preprocessing.sequence import TimeseriesGenerator

n_input = 12

n_features=1

generator = TimeseriesGenerator(

scaled_train,

scaled_train,

length=n_input,

batch_size=1

)

Fit a Model¶

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

# define model

model = Sequential()

model.add(LSTM(150, activation='relu', input_shape=(n_input, n_features)))

model.add(Dense(1)) # Only one predicted result is required.

model.compile(optimizer='adam', loss='mse')

model.summary()

# fit model

model.fit_generator(generator,epochs=100)

model.history.history.keys()

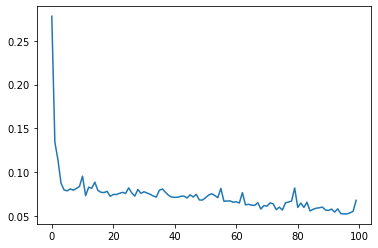

loss_per_epoch = model.history.history['loss']

plt.plot(range(len(loss_per_epoch)),loss_per_epoch)

Evaluate on Test Data¶¶

first_eval_batch = scaled_train[-split:]

first_eval_batch

first_eval_batch = first_eval_batch.reshape((1, split, n_features))

# Generate predictions into the same time stamps as the test set

test_predictions = []

first_eval_batch = scaled_train[-n_input:]

current_batch = first_eval_batch.reshape((1, n_input, n_features))

for i in range(len(y_test)):

# get prediction 1 time stamp ahead ([0] is for grabbing just the number instead of [array])

current_pred = model.predict(current_batch)[0]

# store prediction

test_predictions.append(current_pred)

# update batch to now include prediction and drop first value

current_batch = np.append(current_batch[:,1:,:],[[current_pred]],axis=1)

### Inverse Transformations and Compare

test_predictions

true_predictions = scaler.inverse_transform(test_predictions)

true_predictions

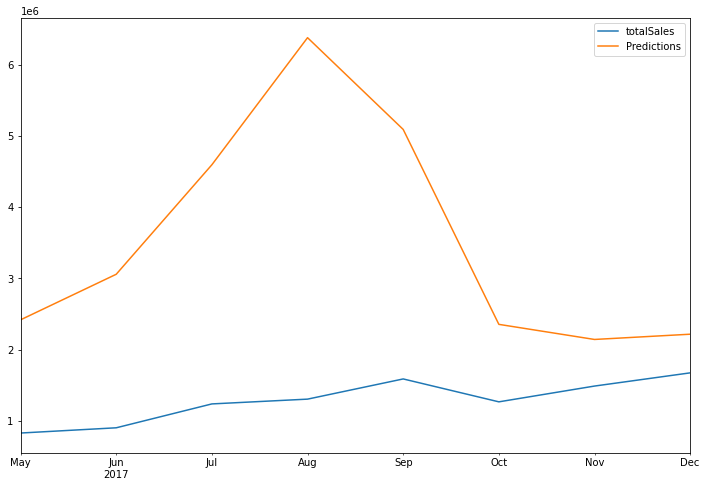

Create a new dataframe that has both the original test values and your predictions for them.

y_test['Predictions'] = true_predictions

test.head()

y_test.plot(figsize=(12,8));

# Plot predictions against known values

title ='Monthly Beijing Housing Total sales'

ylabel='Total sales'

xlabel='Month'

ax = y.plot(legend=True,figsize=(12,6),title=title)

y_test['Predictions'].plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

Error Evaluation¶

print('mse %.5e'% (mean_squared_error(y_test['Predictions'],y_test.iloc[:,0])))

y_test

ModelComparison = addModel(ModelComparison,'RNN',mean_squared_error(y_test['Predictions'],y_test['totalSales']),None)

ModelComparison

Conclusion¶

Based on ModelComparison, the best model was SARIMAX with Grid Search. Next, we use this model.

Step 06 Two months Forecast¶

# Make a

model = SARIMAX(y,exog=exog1,order=(2,1,2),seasonal_order=(2,0,1,12),enforce_invertibility=False)

results = model.fit(disp=0)

exog_forecast = market[['10yrBond']].loc['2017-12-31':]

fcast = results.predict(len(y)-1,

len(y)+2,

exog=exog_forecast[:3]).rename('SARIMAX(2, 1, 2) (2, 0, 1, 12) Forecast')

title='2 months Forecast'

xlabel='Month'

ylabel='Total sales'

ax = y.plot(legend=True,figsize=(16,6),title=title)

fcast.plot(legend=True)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

Save the data¶

market.index.names=['month']

datapath = '../data'

save_file(df, 'df_data_step3b_EDA.csv', datapath)

save_file(market.reset_index(), 'time_sales_data_step3b_EDA.csv', datapath)